A guide to justifying the ROI on a WMS

Identifying and understanding the key drivers behind the ROI for a WMS can help you ensure you have the necessary information to ensure you can cost justify your decision, the payback period and the benefit

Recognising the need for a WMS is a straightforward exercise for many warehouse managers. Inaccurate inventories, customer service issues and pressures to continually reduce costs make the investment decision almost intuitive

Investments are rarely made based on intuition, so the benefits of a WMS can, fortunately, be identified and quantified to provide an accurate basis for justification.

The 3 steps required to build out your ROI justification on your WMS implementation:

1. Define the Problem Areas in your Warehouse

For example, you may find the following problems in each of the above areas:

- Inventory Accuracy and Carrying Cost - excess inventory, misplaced product, and mis-picks.

- Labour Management - problems may include excessive time searching for product, inefficient pick paths, and no or limited pick rate and order fill performance.

- Facility and Distribution Resource Optimisation – inefficient storage methods that lead to under utilised locations and excessive pick, travel and search time and can also lead to unnecessary and expensive building extensions

- Customer Service - Problems often include ship errors and delayed shipments.

- Visibility - Information management problems may include stock-outs, false stockouts, excessive inventory and unnecessary expensive resources

Using these building blocks enables you build a matrix that and create a baseline for the key metrics that you will use to build out the justification for ROI.

We recommend that the advice of an experienced facilitator be leveraged to assist in clearly defining, measuring and creating a baseline issues list.

The warehouse manager will be best suited to present the baseline list of challenges. However, to ensure that all problems have been identified, other stakeholders in the warehousing process should be asked for their input.

2. Estimate Current Internal Costs or Lost Savings

Once warehousing problems have been documented and benchmarked, the next step is to estimate the costs associated with each. This step is critical to understanding the severity of any problems

A variety of equations and industry standards can be used to quickly estimate the costs with examples of typical costs being listed in simple ROI table.

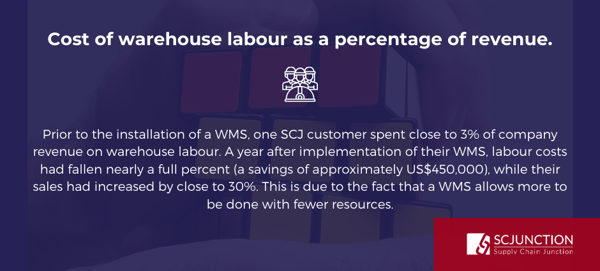

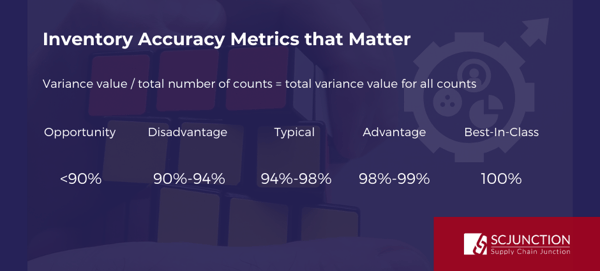

The desire to improve inventory accuracy is another prime reason to invest in a WMS.

Inventory reduction and increased customer service expectations have forced manufacturers, wholesalers, and retailers to re-think traditional inventory management philosophies.

Best-in-class service levels must be achieved within a competitive cost and service structure.

The savings associated with the reduction of inventory levels may themselves justify investment in a WMS. Many companies have reported reducing inventory levels by as much as 30%.

This level of reduction greatly affects carrying costs, which typically equate to 25% to 35% of the cost of inventory.

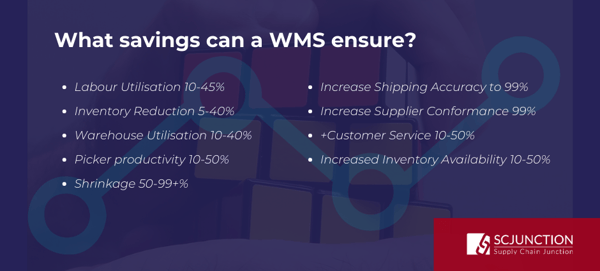

What savings should be expected by implementing a WMS?

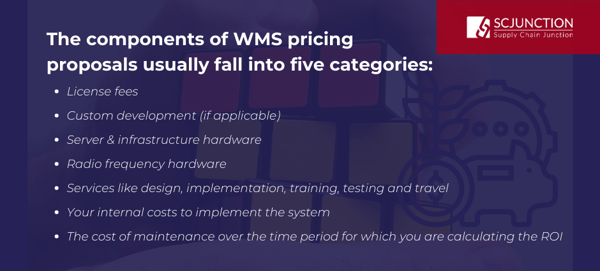

3. What will a WMS cost my organisation?

At this point in the process, it will be reasonably clear how much money and time the right WMS will be able to save. The next step is to determine how much will have to be spent to successfully implement the WMS.

The cost of WMS implementation, by example:

- Using a NPV calculation compares the price of the WMS to the level of future savings that it will provide. One simple example of an NPV consideration is to consider whether you would rather have $100 today or $120 a year from today. NPV considers the time value of money.

- To arrive at an answer in this example, you would have to decide how much interest could be earned in a year on the $100. If you could earn more than 20% you would accept the $100 today because your earnings after one year would be greater than the $120 you would otherwise receive.

- To calculate the NPV on an investment in a WMS, several pieces of information are needed. First, determine the total cost of the system. Second, calculate the annual savings for at least the first four years after implementation.

- Finally, determine the rate of return required by the company on capital investments. Let’s look at an example. Assume you spend $500,000 today for a WMS that will provide estimated savings of $250,000 in the first year and 200,000 in years two to four.

- Remember, these are the savings you calculated in as part of the ROI exercise. Also remember, that the present day value of these savings is less than $250,000 and $200,000 respectively. Your objective in calculating the NPV is to determine the value of those annual savings today and compare it to present day’s cost.

- Assume your management requires a return of 15% on all capital investments. Add the total savings in today’s dollars and assuming your performance can be improved by the necessary standards to meet the industry benchmarks, the investment can be justified.

In addition to the total cost of implementation, there are other important criteria that should be considered when selecting a vendor including track record, size, investment into R&D, financial stability, and the level of trust and confidence between vendor and customer.

Visit our resources page for Smart Warehouse Tools:

Start with the hard costs - Get the Complete Guide to Justifying ROI on your WMS Investment here:

TAGS

- WMS (51)

- Warehouse Best Practice (46)

- Implementing a WMS (29)

- Managing your warehouse (19)

- Omni Channel (18)

- eCommerce (18)

- Blog (16)

- Supply Chain Best Practice (16)

- Customer Journey (9)

- Mid-Level (8)

- Warehouse optimisation (7)

- General Tips (5)

- Industry General (5)

- Information (5)

- Trends (5)

- managing your Supply Chain (5)

- saudi arabia (5)

- Press Release (4)

- smart warehouse (4)

- 3PL (3)

- News (3)

- ERP (2)

- Entry-level (2)

- ROI (2)

- Case Study (1)

- OMS (1)

- Picking (1)

- Solution-Specific (1)

- Transport Management System (1)

Take A Look At The Results Of A Successful WMS Implementation.

See how Tarsus Distribution, in collaboration with SCJ boost overall efficiency by 60%